Have you signed up for a new credit card recently, but you are unsure of how to maximize your point earnings? Have you selected alliances within the travel industry, but it is not clear how much your points/miles are worth? Are you ready to redeem your points/miles, but have no clue how to ensure you are getting a good deal?

For simplicity sake, I am going to universally refer to miles/points as 'points' in this article.

Understanding how to best leverage your credit cards to rapidly accrue points, knowing the value of your accrued points, and learning how to optimize your point redemptions is critical. By doing this well, you will reap benefits and enjoy fantastic (free) vacations. Unfortunately, there is a fair amount of nuisance in this process and the answers are not all black and white. However, there are some tips and tricks I will share with you to make the whole process a little more efficient. Let's break it down...

How can I rapidly accrue points for travel?

You do not have to be a full-time traveler to accrue points within various travel programs. It's the day and age of travel credit cards and not all cards are created equal. If you carefully select your credit cards, pay them off every month, and leverage them appropriately to pay for travel and non-travel expenses, the results can be fantastic. Not only can you increase your credit score (by having a larger amount of available credit), but you can ensure that you have the right card and benefits to maximize earnings. Here are my top suggestions for leveraging your credit card portfolio to build a hefty slush fund of points:

Select your preferred travel alliances and stick with them; all travel companies are price competitive these days, so it's best to pick your alliances and stick with them. Instead of simply buying the cheapest flight or hotel, do your research and book early within your selected alliances. You may not always find the cheapest fare/rate, however the extra money you may spend will be an investment in your next trip. Every trip is an opportunity to earn points, so any one-off trips on non-core alliances can hinder your earning potential over time. Focus your spending within core alliances and watch your points add up rapidly!

Align your credit card portfolio with your travel alliances; there limitless options for credit cards and rewards these days. If travel is your #1 priority, I highly suggest getting the program-sponsored credit cards. There are several benefits, most notably, using the card for purchases within the program itself. For example, the Marriott Rewards Premier Plus Credit Card earns 6 points per dollar spent on Marriott hotel stays, which is triple what you would normally earn using other cards. With the United Explorer Credit Card you get priority boarding and a free checked bag for you and a companion. These things matter when you travel, and can really make your experience more enjoyable.

Get a work-horse credit card that gives you flexibility; there are times where you may not have enough points within one specific program to buy your next flight or hotel stay. By expanding your credit card portfolio to include a good flexible option, you can transfer points as-needed or redeem within the program specifically. Chase Sapphire Reserve is the absolute best card in this category. It provides 3 points per dollar spent on all travel and restaurants, with most competing cards only offering 2 points per dollar. Furthermore, the Chase Travel Portal has limitless options for flights, hotels, and rental cars redemptions.

Here are some of the most important 'rules' I follow for booking and paying for my travel expenses based on my credit card portfolio:

For Hotels:

- Always pay for hotel stays with the Marriott Rewards Premier Plus card to earn 6x points for every dollar spent

For Flights:

- With United Silver Status or above: always pay with the Chase Sapphire Reserve card to earn 3x points (since you already get priority boarding and free checked bag based on your status alone)

- With no United status: always pay with the United Explorer card card to ensure free checked bag, priority boarding, and access to EconomyPlus while earning 2x points per dollar spent

For All Other Travel Expenses (Rental Cars, Taxis, Restaurants):

- Most times you should pay for your rental cars with the Chase Sapphire Reserve credit card to earn 3x points for every dollar spent; but keep a look-out for special promotions within other programs (i.e., Marriott-Hertz)

- Always use Chase Sapphire Reserve credit card for dining to earn 3x points

What are my points worth?

Once you've accrued points across your travel alliances, the next step is understanding how much they are worth. Calculating the value of points across travel programs is an art, not a science. The Points Guy does a fantastic job of calculating valuations and keeping them up-to-date as things change. The key variables that can affect valuations include:

- What is the value of the points when you redeem them?

- How much do points cost if you want to buy them?

- What are the award availabilities, fees, and change/cancellation policies?

Every month The Points Guy publishes the new valuations and includes 'Notes' on what has changed since the last month/year. Check out the September update here. Every month I read this update and focus in on my travel alliances (Marriott, United, and Chase).

So let me explain how the valuation works. Each point earned within a program is worth a certain percentage/multiple of a CENT. In order to accurately estimate the value of your points, you need to first translate the cent to a dollar.

As you can see, Marriott is the least valuable and Chase is the most valuable. Why is that? As I explained above, determining valuation looks at a combination of factors. Chase Points are very valuable because their availability to redeem is high, they can be transferred 1:1 to several travel partners, and their redeemable value gives you a great bang for your buck. Marriott on the other hand, is lower because availability to book with points is moderate and redeemable value is relatively low (i.e., it takes a lot of points to book a one-night stay). This is not to say you should avoid banking points with these programs, though. Each program has it's pros/cons and it's always good to have a balanced program portfolio.

Keeping a hearty amount of points across your programs will give you flexibility when it's time to book your next trip. To calculate the 'Value' of your points, simply multiply your 'Points Accrued' by the 'Point Valuation ($)'. This 'Value' will now help you understand how much 'money' you have to spend and is the first step to determining how to leverage your points for redemptions.

How Do I Optimize Redeeming?

Now that we have discussed point valuation, let's talk about how to redeem points. If you are like the example above and have points in your accounts across programs, the good news is that you have options when redeeming. A common misconception is that you should always redeem your points isolated within one program. Another common misconception is that transfer-ability across programs is always advantageous. Both are not true! Here are my top options to consider when redeeming points within my core programs:

Earn Marriott Points - redeem Marriott Points on Marriott Website

- Only good if: you've confirmed you're getting a good deal (more on this below)

Earn Marriott Points - transfer Marriott Points to United (3:1 ratio); 30,000 Marriott Points = 10,000 United Miles

- Only good if: you do not have enough United points for your flight and the transfer value is high (i.e., your flight is quite expensive to pay for in cash and point redemptions for the flight are available)

- Important Note: the reverse transfer (United to Marriott) does not exist

Earn Chase Points - use Chase Points within the Chase Portal

- Only good if: you've confirmed your desired flight/hotel is available in the Chase Portal, you've confirmed you're getting a good deal (more on this below)

Earn Chase Points - transfer Chase Points to Marriott or United (1:1 ratio); 10,000 Chase Points = 10,000 Marriott Points or United Miles

- Only good if: you desperately need the points in your other accounts, your desired flight/hotel is NOT available in the Chase Portal

- Important Note: Since Marriott and United point valuations are LESS than Chase, when you transfer 1:1, you are LOSING valuation by transferring; therefore, this option is highly discouraged!

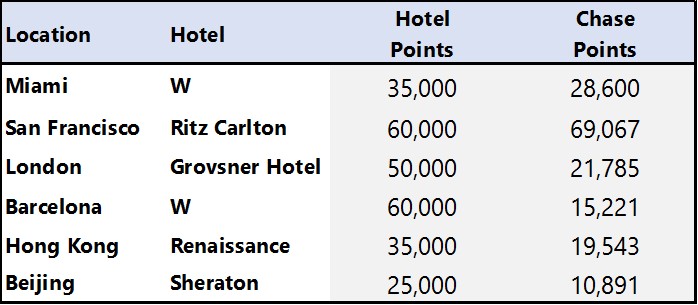

So what is the best way to apply your redemptions and how do you confirm that you are getting a good deal? I've created an example below focused on hotel redemptions. In this example, I searched for a one-night stay at various hotels across the Marriott program during the Thanksgiving holiday. The first step is to note down how many points are required per night - both on Marriott's website and the Chase Travel Portal.

At first glance, it may appear that Chase Points are more advantageous because they require lower points across the board. However, remember that the value of these points is different! You must calculate out the points by the '$ Valuation' multiple we calculated above to understand how much it really costs you to redeem these points.

*Note: For the Chase Valuation multiple, I used 1.5 cents instead of 2.0 (from Points Guy), since this is the true redeemable value on the Chase Site

Simply multiply the number of points by the 'Point Valuation' multiple to see how much it 'costs' you to redeem these points across both programs. Run down the list and highlight the lower cost option for each, and that is the program you should use to redeem your points. For example, redeeming with Marriott for the W Hotel in Miami is a better choice since it costs $315 worth of points versus $429 if you redeem with Chase. On the other hand, the W Hotel in Barcelona is significantly more advantageous to redeem with Chase points ($228.32 versus $540 with Marriott).

But let's not stop there. One additional factor that I always encourage people to validate is the CASH option. Sometimes using your points does NOT make sense because you won't be getting a great bang for your buck.

In the example above, I searched for paid stays on the Marriott website and noted the cost per night (green column above). Then, line by line, I highlighted the lowest cost option and noted the recommended 'Choice' for redemption. As you can see, the Renaissance in Hong Kong and the Sheraton in Beijing are both better suited to pay for in cash because the point redemption options are more expensive. While you may prefer to use points regardless of how much cash it costs to redeem, it is always important to check in advance to see if cash may be a better option. Also, Marriott often includes a 'Cash + Points' option whereby you can use a combination of points and cash to pay for your stays. Cash options are often overlooked, but should be considered when determining how/when to redeem your points.

In Summary

Determining your travel alliances upfront and sticking with them, leveraging your credit cards to accrue points strategically, and doing simple math to optimize your redemptions can be game-changing tactics. Put all of these strategies together and you have the formula for increasing your leverage to book amazing vacations -- for free! Next time you are getting ready to book travel with your points, spend a bit more time analyzing your options to ensure you are getting a good deal. That way, you can feel confident in your decisions and sit back and relax your well-deserved vacation!

Reach out to me directly for a copy of my spreadsheet to help you do these calculations in minutes!